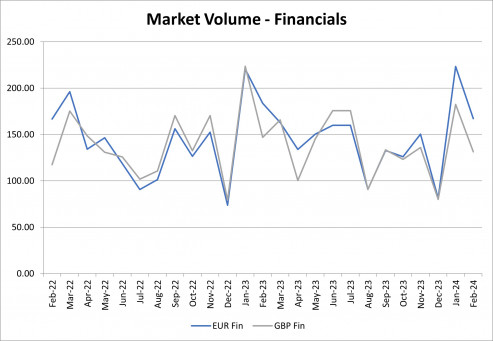

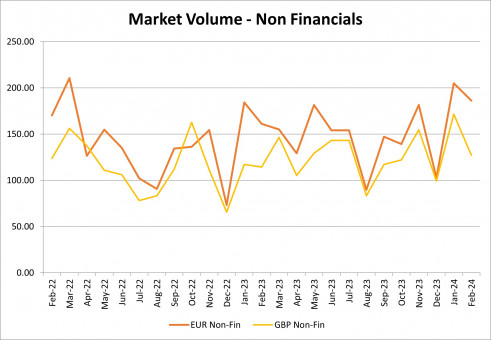

Market Volume: Observed trades in EUR and GBP investment grade corporate bonds

ICE Data Services incorporates a combination of publicly available data sets from trade repositories as well as proprietary and non-public sources of market colour and transactional data across global markets, along with evaluated pricing information and reference data to support statistical calibrations.

The market volume evolution represents the changes in the monthly aggregate volumes of all observed trades in securities in the relevant group, based to 100 as at September 2015. EUR Financials include approximately 4000 securities, GBP Financials 1500, EUR Non-Financials 3000, and GBP Non-Financials 1000.

ICMA intends to publish and monitor the market volume of IG Financials and Non-Financials on a monthly basis upon necessary permission of ICE Data Services.

Source: ICE Data Services

Top-traded corporate bonds in February 2024 (by volume)

ICE Data Services sources publicly available data sets from trade repositories and procures information from non-public sources of market colour and transactional data across global markets. Additionally, market colour, bid lists, dealer runs, and other transactional data is received from their global network of clients on the buyside and sell-side.

While the rankings are based on traded volumes, the right-hand column (of below tables) indicates the relative volume of each bond expressed as a percentage of the most actively traded bond’s volume (100%).

EUR Financials

| Rank | Issuer | Coupon and Maturity | ISIN | Relative volume |

| 1 | KREDITANST FUR WIE | 0.875% GTD SNR 04/07/39 EUR | DE000A2TSTR0 | 100% |

| 2 | KREDITANST FUR WIE | 2.625% GTD SNR 10/01/34 EUR | DE000A352ED1 | 97% |

| 3 | KREDITANST FUR WIE | 2.375% GTD SNR 05/08/27 EUR | DE000A351Y94 | 59% |

| 4 | COOPERATIEVE RABOB | 1% SNR NPF MTN 26/07/34 EUR | XS2753315626 | 56% |

| 5 | KREDITANST FUR WIE | 2.875% GTD SNR 29/05/26 EUR | DE000A351MM7 | 50% |

| 6 | KREDITANST FUR WIE | 2.875% GTD 07/06/2033 EUR | DE000A30V9M4 | 47% |

| 7 | AGENCE FRANC DEV | 3% SNR 17/01/2034 EUR100000 | FR001400N7K2 | 42% |

| 8 | KREDITANST FUR WIE | 3.125% GTD SNR 10/10/28 EUR | DE000A351MT2 | 33% |

| 9 | Export Development Canada | 2.625% UNSUB NTS 18/01/2029 EUR | XS2748850687 | 27% |

| 10 | BAYER LANDESBANK | FRN SNR NPF 01/26 EUR100000 | DE000BLB9V03 | 25% |

Source: ICE Data Services

GBP Financials

| Rank | Issuer | Coupon and Maturity | ISIN | Relative volume |

| 1 | KREDITANST FUR WIE | 4.875% GTD SNR 10/10/28 GBP | XS2679764493 | 100% |

| 2 | KREDITANST FUR WIE | 3.75% GTD SNR 09/01/29 GBP | XS2744169637 | 64% |

| 3 | Export Development Canada | 3.875% UNSUB NTS 03/10/2028 GBP (REG S) | XS2752075783 | 50% |

| 4 | KREDITANST FUR WIE | 0.875% GTD SNR 15/09/26 GBP | XS2034715305 | 32% |

| 5 | BARCLAYS PLC | 7.09%-FRN SNR 06/11/29 GBP | XS2711945878 | 30% |

| 6 | BANCO SANTANDER | 5.375% SNR 17/01/2031 GBP | XS2748853194 | 30% |

| 7 | The Toronto-Dominion Bank | FRN UNSUB CVD BDS 18/01/2027 GBP (REG S) (CBL63) | XS2749463936 | 28% |

| 8 | SOCIETE GENERALE | FRN SNR NPF 22/01/2032 GBP | FR001400NCB6 | 28% |

| 9 | KOMMUNALBANKEN AS | 4.125% SNR 22/07/2027 GBP | XS2760760277 | 27% |

| 10 | HSBC HOLDINGS PLC | 6.8%-FRN 14/09/31 DUAL CURR | XS2685873908 | 26% |

Source: ICE Data Services

EUR Non-Financials

| Rank | Issuer | Coupon and Maturity | ISIN | Relative volume |

| 1 | INTRUM AB | 4.875% SNR 15/08/2025 EUR | XS2211136168 | 100% |

| 2 | BMW US CAPITAL LLC | 3.375% GTD SNR 02/02/34 EUR | DE000A3LT423 | 97% |

| 3 | NORDRH-WESTFALEN | 3.4% SNR 07/03/2073 EUR1000 | DE000NRW0N26 | 87% |

| 4 | NIEDERSACHSEN | 2.625% SNR 09/01/34 EUR1000 | DE000A3823L6 | 78% |

| 5 | INTRUM AB | 3.5% SNR 15/07/26 EUR100000 | XS2034925375 | 72% |

| 6 | REGION WALLONNE | 3.5% SNR EMTN 15/03/43 EUR | BE0002923044 | 72% |

| 7 | ARDAGH PACKAGING F | 2.125% GTD 15/08/2026 EUR | XS2189356996 | 72% |

| 8 | EDP SERVICIOS FINA | 4.375% SNR 04/04/2032 EUR | XS2699159351 | 70% |

| 9 | INTRUM AB | 3% SNR 15/09/2027 EUR100000 | XS2052216111 | 67% |

| 10 | BMW US CAPITAL LLC | 3% GTD SNR 02/11/27 EUR1000 | DE000A3LT431 | 66% |

Source: ICE Data Services

GBP Non-Financials

| Rank | Issuer | Coupon and Maturity | ISIN | Relative volume |

| 1 | ARDAGH PACKAGING F | 4.75% GTD SNR 15/07/27 GBP | XS1628848241 | 100% |

| 2 | VONOVIA SE | 5.5% SNR 18/01/36 | XS2749469115 | 73% |

| 3 | CASTLE UK FINCO PL | 7% GTD SNR SEC 15/05/29 GBP | XS2447921896 | 65% |

| 4 | ALLIED UNVL HOLDC/ | 4.875% GTD 01/06/2028 GBP | XS2342058034 | 48% |

| 5 | GLENCORE FIN EUR L | 3.125% GTD SNR 26/03/26 GBP | XS1968703345 | 46% |

| 6 | SIEMENS FINANCIER | 1% GTD SNR 20/02/2025 GBP | XS2118273866 | 43% |

| 7 | THAMES WTR UTL FIN | 7.125% GTD 30/04/2031 GBP | XS2755443020 | 43% |

| 8 | THAMES WTR UTL FIN | 7.75% GTD 30/04/44 GBP1000 | XS2755443376 | 42% |

| 9 | PUNCH FINANCE PLC | 6.125% GTD 30/06/2026 GBP | XS2357307664 | 42% |

| 10 | TALK TALK TELECOM | 3.875% GTD SNR 20/02/25 GBP | XS2121167345 | 40% |

Source: ICE Data Services

Download

Historical data of the most actively traded corporate bonds on a monthly basis can be found below:

January 2024

December 2023

November 2023

October 2023

September 2023

August 2023

June 2023

May 2023

April 2023

March 2023

February 2023

January 2023

December 2022

November 2022

October 2022

September 2022

August 2022

See our archive for data (from January 2018).

This document is provided for information purposes only and should not be relied upon as legal, financial, or other professional advice. While the information contained herein is taken from sources believed to be reliable, ICMA does not represent or warrant that it is accurate or complete and neither ICMA nor its employees shall have any liability arising from or relating to the use of this publication or its contents.

© International Capital Market Association (ICMA), Zurich, 2024. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without permission from ICMA.